Financial expert and planner Teresa Bear is often asked how much money should be kept in savings. While there could be several explanations/recommendations Bear recommends keeping three to six months of income in liquid savings. Liquid savings can be accessed quickly in case of emergencies.

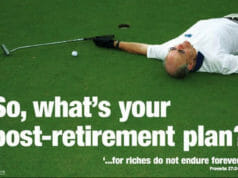

Bear acknowledges saving can be a challenge, but she suggests it is good to start the savings habit at a young age. One way to start is to live beneath your means. She suggests the next time you get a raise to put 1% in a savings account and 1% in the company 401K. Eventually you live off 90% of take home pay with 10% going to permanent savings. Once the goal of 3-6 months savings is reached, it is time to start working on permanent retirement savings.